Building the risk profile

There are a number of considerations in determining the risk profile. To evaluate financial risk, companies require an understanding of risks related to their products (scientific risk assessment), and the risk this has on their financial bottom line (financial risk assessment).

Scientific Risk is defined as:

Risk = Hazard x (p)Exposure

Where (p) = the probability of exposure.

Using a risk-based approach enables companies and regulatory agencies to determine whether or not the product – even if it is hazardous – can be used or consumed safely. For example, even if the hazard is particularly dangerous or severe, but the likelihood of exposure is very low – then the risk is deemed as low. Or if the hazard is of very low severity/impact yet consumers are frequently or readily in contact with it, the risk may none-the-less be high. Therefore, the better the hazardous properties are understood and the more refined or accurate the exposure estimates can be made, then the more accurate the overall understanding of product risk can be.

From the perspective of a company placing a product on the marketplace, proper understanding of hazard and exposure has wide ranging implications. It impacts product formulation, the conditions of use, and any safety claims or warning requirements – because it fundamentally describes how and under what circumstances a product can be used safely. For example, concentrated bleach is highly hazardous. Dermal exposures can cause severe chemical ‘burns’ while oral exposure (drinking it) can cause death. However if the exposure to bleach is reduced – by diluting it, or wearing protective gloves, or keeping it in a bottle with a tamper proof seal, then that bleach can be used safely and even stored under your kitchen sink! However, it is when both hazard and exposure are medium or high then the risk will be estimated at a concerning level.

There are numerous types of hazards and exposures which we face in the products and food we interact with every day – each one with an associated severity of effect (harm) and likelihood of occurrence. Here are some elements to consider.

Exposure

Exposure is particularly difficult to determine and is usually expressed as a probability in the risk equation, because it can vary considerably depending on the population being exposed, and formulations of products that are available, and the extent to which people use them for example. Creme Global’s expertise provides refined and accurate exposure models for a range of different hazards, enabling companies and regulatory agencies to better understand and manage the risks those products may pose. (include links here to the expert models). In order to get a more accurate representation of a real-life scenario, a deeper level of analysis is required for each product or product line a client produces or sells, as well as a more refined definition of the types of hazards and exposures relevant to each product. Creme Global has created secure, confidential data platforms which allow such aggregate exposures to be better quantified.

There can be a multitude of hazard types, including chemical, biological, processing contaminants, and physical, or foreign (unwanted) objects, dilution and substitution. Within each of these broad categories, there are a vast array of individual chemicals, microbiological pathogens, and different physical contaminants or foreign materials. They are, for the most part, all regulated to acceptable levels of inclusion. Oftentimes the question both companies and regulators are trying to answer is “Is It Safe?” – or more accurately – “Can it be used safely?” Because if not, the consequences can be serious and costly – to human and environmental health but also to a company’s reputation, and in the form of clean up and reparation costs.

There are many different ways in which individual hazards can occur in a product, and how people and animals can be exposed to them. Some are intentional exposures because they are a necessary ingredient in the products formulation, while others are the result of accidents and, unfortunately, there are always those which are the result of deliberate or illegal contamination, or fraud.

Creme Global provides a suite of evaluative tools and models which allow companies to identify the likelihood of occurrence and exposure to intentional, unintentional and illegal hazards within their products, be they a personal care product, a cosmetic, a food, or a crop protection product.

Example 1: Contaminants within a product matrix

One of the first things to evaluate, when looking at a complete product, is how likely it is for an illegal hazard to occur for a given scenario. For example, a physical hazard, such as the likelihood of broken glass being in a product. The same can be said for the likelihood of a particular pathogen, or a contaminant such as an unintended chemical. There are many factors that can be used to determine this, for example, past precedent, the complexity of the supply chain, propensity of fraudulent activity for a given product, reports from RASFF (Rapid Alert System for Food and Feed) or other sources on similar outbreaks.

For certain hazards there may be a legally acceptable quantity or allowable concentration, which is regulated such that when adhered to, it protects the consumer from harm – such as illness or poisoning for example. There are a variety of such measures that can be used within a modelling construct to quantify acute or chronic exposures, for example, the Disability-Adjusted Life Year (DALY).

For chemical risk – either of contaminants or as legally included ingredients – there are typically 3 routes of exposure that are considered: ingestion (oral), lung inhalation and dermal (skin). Each factor has its own unique set of conditions for transfer into and movement through the body – determined using studies that evaluate the absorption, distribution, metabolism and excretion (ADME) of the compound. These can affect what is known as the internal toxic dose, as opposed to the external toxic dose, which is the dose in the environment, outside the body, to which the individual has been exposed.

It is also important to determine the number of people who may be exposed to any specific hazard and in what quantities. Not everybody uses the same product every day, or in the same amounts for example. The severity of the effect may also depend on the vulnerability of the population that is being exposed. Vulnerability can depend on characteristics such as age, weight, gender, susceptibility to illness, baseline concentrations of a chemical in the body, genotype and so on. Consequently, the distribution of the product’s use across a population, or by a vulnerable sub-population (i.e. an infant) may need to be considered in greater depth when evaluating severity and risk.

Creme Global has curated data sets that cover many countries and many years of consumption and use habits of individuals. These, in combination with probabilistic models, and ADME data can determine the transfer and movement of hazards through the body – thus closely representing real-life scenarios.

All of the above factors which need to be considered in order to develop an accurate risk score. Our interactive software tool can be used to adjust the various factors and the user can observe the impact that adjusting the various inputs and assumptions can have on the output. This can then be replicated for many product lines.

Financial Risk

From a financial risk perspective, risk is determined by the amount of money a company stands to lose should there be a failure in the system. This includes immediate costs but also the loss of future revenue.

Financial exposure = costs + lost revenue

Costs can be made up of direct costs related to the expenditure required to resolve the issue, recall costs, cost of disposing of products, withholding shipments, inspections, cleanups, staff retraining, communications and media consultancy costs and so on. Indirect costs may also include processing costs for work in progress (WIP) that must be disposed of, the time and resources of staff members tied up in resolving this and so on. It’s also worth considering the potential costs of increased insurance as well as lost revenue from the recalled stock.

However the immediate loss of revenue may pale in significance when compared with the lasting impact on consumer confidence caused by halted or cancelled orders or public recalls. This can lead to losses of future revenue through a combination of brand or reputation damage, hampered ability to win new customers or develop new market opportunities as well as prolonged legal fallout. (need some links to examples of impacts here for the media)

Determining the Risk Score

We can bring together the above explained parameters of Risk and Financial exposure in a simple manner as outlined below.

Risk score = Risk x Financial exposure

In the simplest scenario, this would result in a single score for a given set of conditions, however all of the criteria that go into this calculation have an inherent probability of occurring and therefore a single value is unrealistic and often highly conservative – representing the worst-case scenario. By repeating the same Risk Score calculation for a number of different sets of conditions, using a ranked list, average score or a visual representation of hot spots, a more accurate score can be developed, one which ultimately allows for more refined, targeted and effective approach to managing risk. Adding more complex algorithms or weightings can refine the results further, enabling a targeted approach which can increase efficiencies and reduce costs, such as staff costs or the recall of more product than is necessary.

Creme Global uses carefully curated data sets and sophisticated models developed in-house to determine the business impact for large multinationals companies in the food and agribusiness. These models help them better understand the financial risks associated with their particular circumstance or conditions.

Example: There are many products where ingredients are used in tiny concentrations, but the number of people exposed to them can be large (high aggregate exposure). The Creme Global tool brings together likelihood and severity of many hazard types, determines the number of people exposed and the business impact score associated with this. This has unearthed highly valuable insights on product lines that had very limited revenue but which were causing a disproportionately high financial risk due to the likelihood, severity and number of people exposed.

Creme Global works closely with producers to review their suppliers and assess the level of financial exposure to each ingredient line and each individual supplier. This way Creme Global develops strategies to reduce client dependence on risky suppliers or product ingredients, effectively reducing their business risk.

Value of Probabilistic Modelling

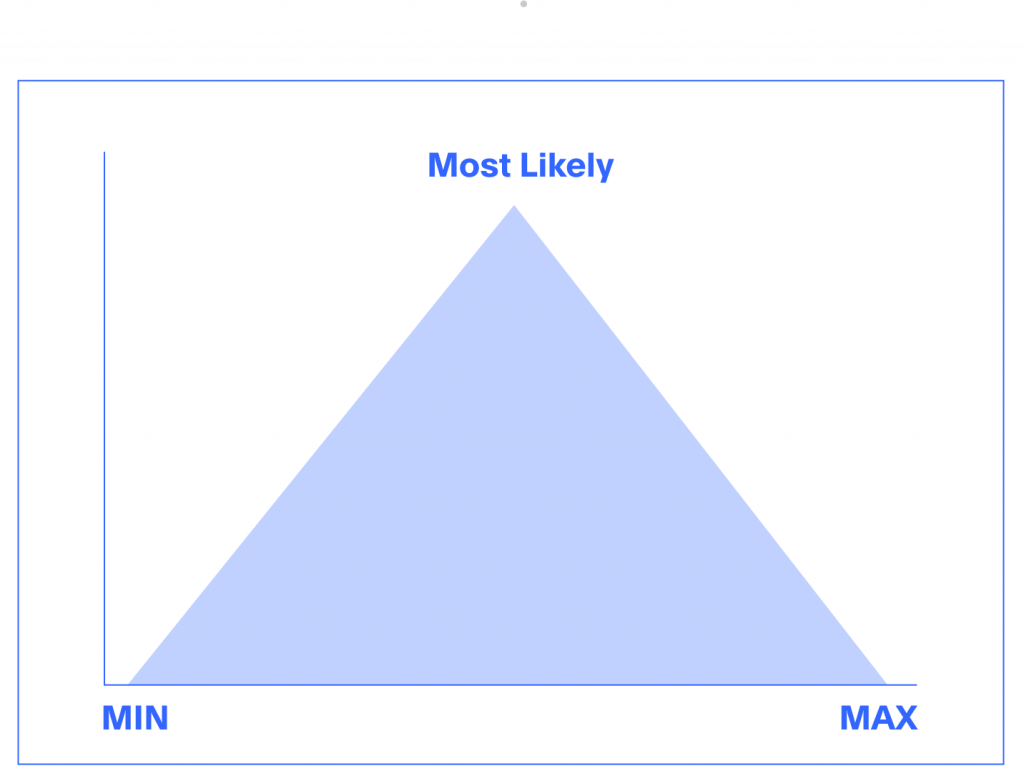

In many of the scenarios outlined above, assumptions have to be made and predictions computed. Giving a single point estimate can be very challenging and inaccurate and often relies on the worst-case scenario. It is typically more realistic and accurate to give a range. For example, a minimum, maximum and most likely value. It should be much easier for a group of experts to come to a consensus on these range values than on a single point estimate.

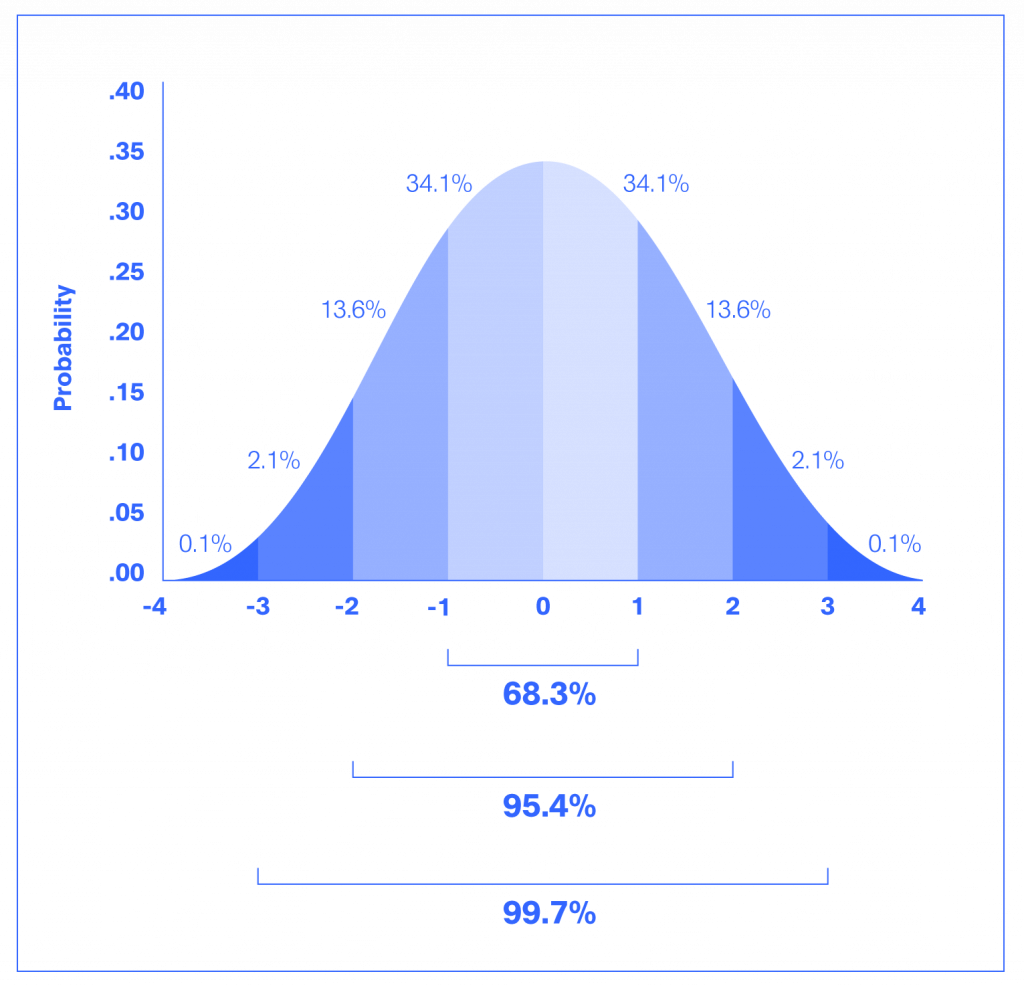

This technique requires the use of probabilistic modelling. Evaluating a range of possible input values requires the model to be run repeatedly with many different input scenarios. The greater the number of variables with range inputs, the greater the number of iterations required and the greater the complexity of interpreting the output. Adding probabilistic modelling accounts for variation in all possible inputs and provides confidence intervals for each estimated output.

Developing a strong organizational culture is essential for enhancing food safety and improving cooperation across the supply chain. Creme Global’s insights on gaining leadership and organizational support for data sharing emphasize how transparency and data-centric practices are key to managing risks effectively. Organizations that implement real-time data sharing and leverage predictive analytics can proactively address potential food safety threats, fostering a preventative approach rather than a reactive one. This collaborative culture ensures that all stakeholders — from manufacturers to supply chain partners — are aligned in maintaining high safety standards. With increasingly stringent regulations, companies that embrace innovation and prioritize data sharing will not only improve compliance but also strengthen trust with both consumers and regulatory authorities.

It’s clear that determining the risk profile is a challenging and complex task, but the applied use of relevant data sets and cutting-edge probabilistic modelling can help to overcome this complexity and simplify the task ahead. Creme Global has extensive expertise in running large calculations, on Big Data using our scalable cloud-based platform Expert Models®. Valuable insights, reduced financial risks and a preventive approach to brand damage are all achievable through the creative, consultative and scientifically validated use of probabilistic modelling.